This past Thursday, we held our latest Martech Happy Hour event at our New York office, together with Surgo Group. Surgo is an intelligence engine that uses data and technology to predict the future.

At this event, they gave us some of their predictions on the future of ecommerce.

Here are some of the key takeaways.

What are the current issues we see in ecommerce?

- Many companies believe they’re underperforming during the “glory days” of online shopping.

- Declining search conversions.

- Clients complain of what they believe are “Amazon-only” or “Instagram-only” competitors appearing out of nowhere.

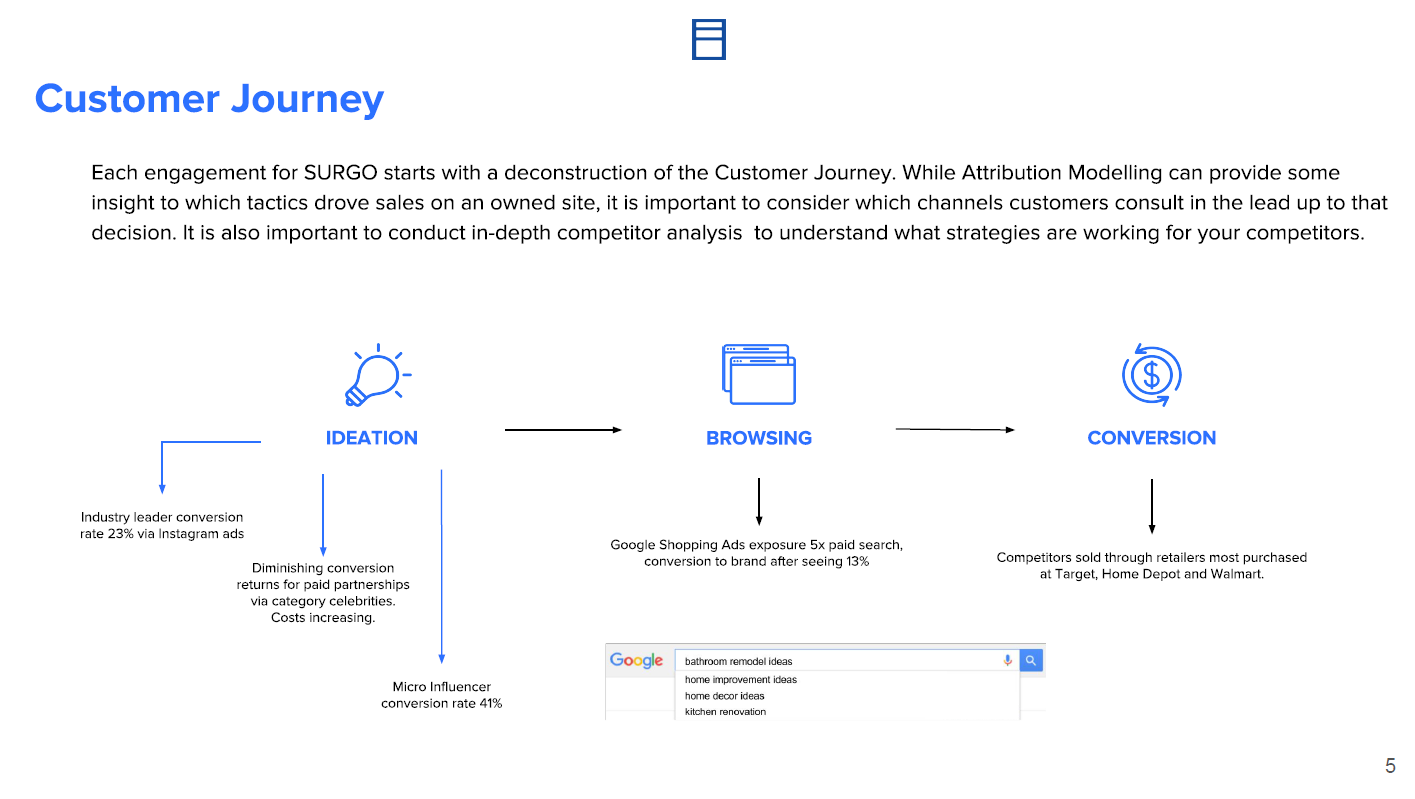

What does the customer journey look like for ecommerce in 2019?

Ideation –> browsing –> conversion.

That’s the essential breakdown of the ecommerce customer journey.

Check out these stats Surgo gave us around the customer journey:

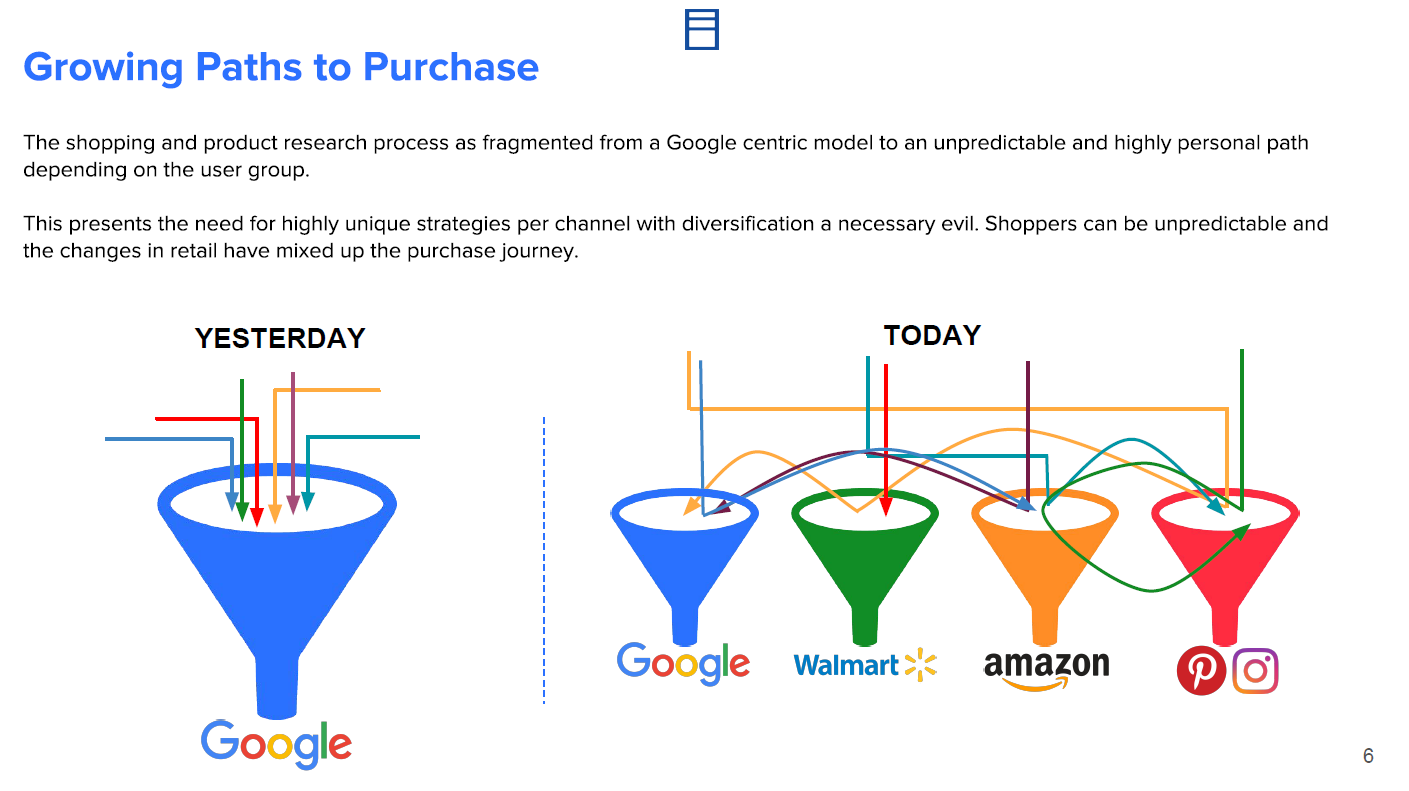

How are the paths to purchase in ecommerce changing?

Yesterday, the average shopper’s path to purchase consisted largely of just Google.

Today, the once Google-centric path has become highly personal to each user and user group.

Increasingly, we see consumers hopping between Google, Walmart, Instagram, Pinterest, Amazon, etc.

What kind of ecommerce data do we need to be looking at?

As Surgo said, “Do your homework.”

For them, “homework” includes keyword analytics for millions of keywords across 5+ years, large-scale SERP collection, and in-depth ecommerce platform analysis.

When considering this question, remember that your most valuable dataset is already available: Your current consumers.

Here are some data sets to consider:

- What price points people buy at

- Granular traffic data

- Search high to low, low to high, most recent, etc

- Cart abandonment

- Traffic sources

What trends are we seeing for Google Shopping in 2019?

Two main trends here:

- Increasing demand for ad space on Google Shopping

- Growing visibility of Google Shopping on the Google SERP in general

And what trends / challenges do we see for Amazon ecommerce?

The main trends for Amazon were around picking products, analyzing success, and running product ads.

One main challenge of Amazon Advertising is that not much data is shared in the Amazon Ads accounts.

Which leads some companies / agencies — like Surgo, for example — to do some interesting analysis themselves. Surgo collects data on product lists and how they change over time.

Another challenge with Amazon is the struggle to compete on price — especially when you’re up against Amazon themselves. In this case, Surgo suggested using coupons, as well as one slide in the image carousel that lists the poignant points about product.

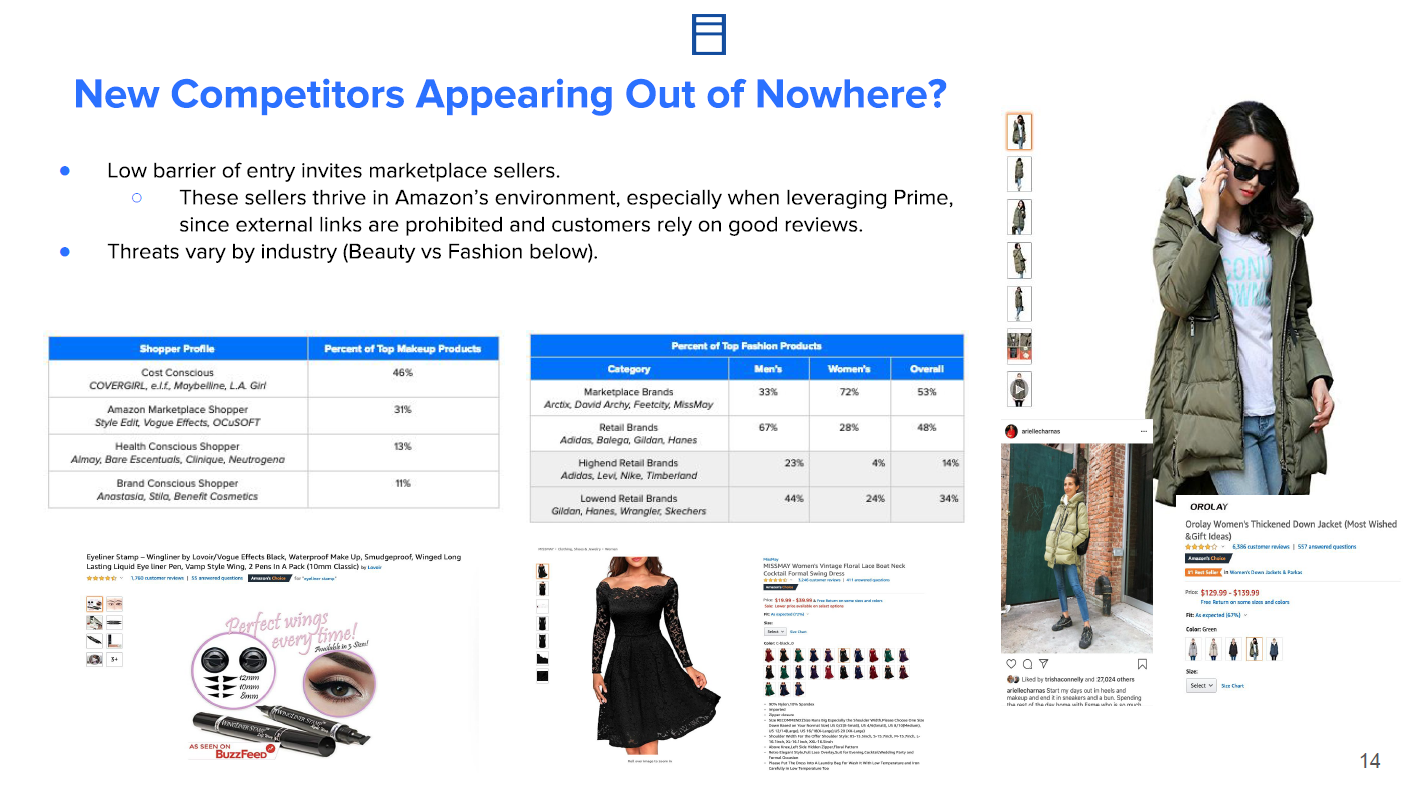

A third challenge for Amazon ecommerce: New competitors appearing out of nowhere.

Case in point: this $110 down coat that’s taking market share from Canada Goose. (Beauty products are another big instance of new competitors popping up against companies like Loreal, Maybelline, etc.

What other kind of data analysis can / should we be looking at for ecommerce?

Surgo also discussed other cool things we can do with data. See more details in the slide clip below, but overviews include:

- YouTube Unboxing videos

- YouTube influencer analysis, how are brands performing based on what influencers are wearing

- Instagram influencer and emoji analysis

- Tagging emoji language

- Influencer growth data

What other ecommerce trends should we expect for the rest of the year?

- Amazon shopper network gaining lots more traction.

- Create social media profile where you list your reviews, can show who has top reviews.

- B2B shopping growth

- Influencer brands

Again, read more info in this slide clip:

Finally, Surgo addressed a couple other topics.

They get their data from a combination of panel, propietary services, similar webs, quantcasts, etc, and blend it all together. They then compare that data to actual traffic from websites they own.

Tracking on the Amazon app

How do these trends compare between the Amazon app and website?

Tracking data is not where it should be for apps. “It’s the next walled garden,” they say. But the Amazon app probably sees about 50% of their traffic. To combat that, they try to use actual extractions of listings, versus users.

Voice search on Amazon

What happens if someone says “red shoes?”

- More difficult to know, but they do have keyword tools that take those into account.

- They’ve been looking at how many functions on top of Alexa are being developed.

- They can’t say, “2% of purchases are made on Alexa” — they don’t have that information.

All in all, quite an interesting and insightful event! Thanks again to Surgo Group, and looking forward to the next #MartechHappyHour.

The post Ecommerce disruption 2019: Data and trends for what to expect this year appeared first on ClickZ.

from ClickZ https://ift.tt/2EfjZF9

via IFTTT

No comments:

Post a Comment