30-second summary:

- Healthcare and educational institutes win consumer trust while media and government struggle

- March saw push notifications reach their highest direct open rates and 32% of website visits were through these mobile app push notifications

- Mobile remains the best way to engage people with push notifications

- DemandLab’s recent ‘Martech stack optimization survey’ reveals that 53% of marketing leaders have no plan in place for their martech stacks

- Deals have shown a positive graph, Australia and Germany are opening up their economies due to some relief from the COVID-19 hit

- Conviva study segments streaming behavior across regions and devices – TV, PC, live streaming, and video on demand

- Standard ads vs COVID-19 based ads, what performed better?

- More on what CMOs’ immediate budget actions should be

Information is power and mental health is key. In light of current events, we took the onus to save you the effort and have scoured numerous sources to empower you with the best marketing world insights this week.

Where are consumers putting their trust? Healthcare and education are winning while retail and media suffer

People continue to remain concerned about COVID-19’s ramifications on the global economy. Gongo’s report shows that 58% believe that there will be a long term economic impact on the economy.

This incremental list depicts the amount of consumer trust received:

- Healthcare providers – 70%

- University and academic institutions – 51%

- Bank/financial institutions – 44%

- Product manufacturers – 41%

- Retailers – 41%

- Insurance companies – 35%

- Media – 31%

- Hotels/ restaurants – 29%

- Govt – 27%

People sentiment – 50% feel anxious while 22% remain optimistic

You can gauge that people will feel big feelings as the pandemic stays like an unwelcome guest, Gongo’s survey gives you clear insight into what exactly are the masses’ feelings:

- Anxiety – 50%

- Frustration – 45%

- Fear – 32%

On the bright side, feelings of calm and optimism have grown

- Calm – Grew from 17% to 20%

- Optimistic – Grew from 22% to 24%

Whereas, 22% of people continued to feel empathetic (the only stat that has remained constant).

Mobile app push notifications – The catalyst for customer engagement / The power of push notifications

Right from email blasts to social media outreach, brands are trying every possible way of classic marketing. But according to Airship mobile app push notifications are the underdog that have been winning more and more eyeballs/capturing more viewership.

In their benchmark study of over two billion app installs across 15 industry verticals, Airship discovered the power of push notifications. March saw push notifications reach their highest direct open rates and 32% of website visits were through these mobile app push notifications.

Here are some key stats:

- Businesses sent our more mobile app push notifications (16%) and web notifications (36%)

- Direct open rates increased by 22% for apps and 119% for websites

- Mobiles prove to be the best way to get people to open your notifications as they stand at 88%

Brett Caine, CEO and president, Airship said,

“These trends show increasing marketer reliance and consumer receptivity to in-the-moment notifications, which is positive, but businesses must ensure messaging is helping to streamline operations and orchestrate excellent customer experiences across channels to leverage as much from digital as possible in these trying times.”

Media businesses dominated push notifications

Even though the media industry seems to be struggling in terms of earning trust, engagement is something it is winning at.

Send volumes of push notifications, especially, news based notifications saw the biggest month-on-month jump at 43% while they enjoyed a 60% direct open rate.

The send volume for web notifications rose by 52% and saw a 119% growth in direct open rates.

A glimmer of hope for the travelling ship

Travel related notifications saw a second-highest drop in direct open rates by 23% since February.

However, travel and transportation saw the largest increase in Message Center read rates at 158% in March as they shifted the focus of messaging from “day-of-travel messaging” to “broader informational updates”.

Marketing leaders have no strategy for martech stack optimization

Yes, you read that right. 53% of marketing leaders have no plan in place for their martech stacks. DemandLab recently released its ‘Martech stack optimization survey’ which was exclusively focused on 117 senior-level CMOs, owners, and C-suite executives to clearly understand martech’s role in marketing strategy, customer experience, and ROI generation.

Top three challenges to martech stack optimization

- 41% Marketing efficiency

- 37% Marketing ROI

- 33% Revenue attribution

Another interesting find was that 71% of these senior and C-level executives are outsourcing some of all of their martech optimization due to the lack of specialized tools and in-house knowledge.

Rise of the marketing phoenix

Episerver’s recent research of 600 global decision-makers in IT, e-commerce and marketing roles at B2B organisations had some interesting insights on what can create better business opportunities:

- 41% believed selling directly to customers online is the most significant opportunity for their business in the next year

- 37% believed expanding into new geography would help

- 36% said providing their salesforce with digital selling tools

Despite the hard times, 85% of B2B organizations expect their digital experience budget to go up in 2021.

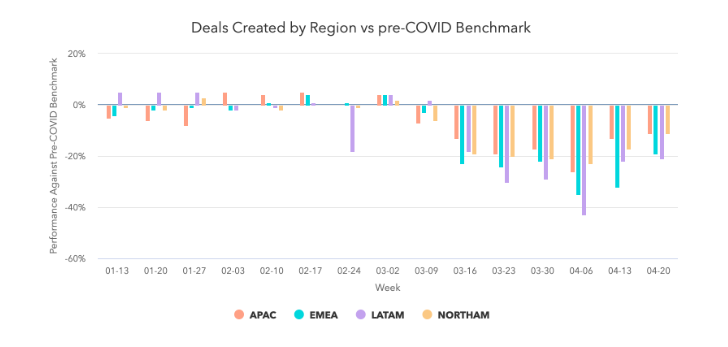

Deals and buyer engagement have shown positive attrition according to Hubspot’s weekly survey of 70,000 customers globally on core business metrics.

Last week saw the highest deals closed which is an 8% increase in the April 20 week.

Email marketing saw some of the highest open rates and sales teams are booking more meetings.

Region-wise gains

Australia and Germany have begun to reopen their economies.

- Europe, Middle East, and Africa rose by 18%

- NORTHAM rose by 7%

- Asia-Pacific Countries collectively rose by 2%

- Latin America collectively rose by 2%

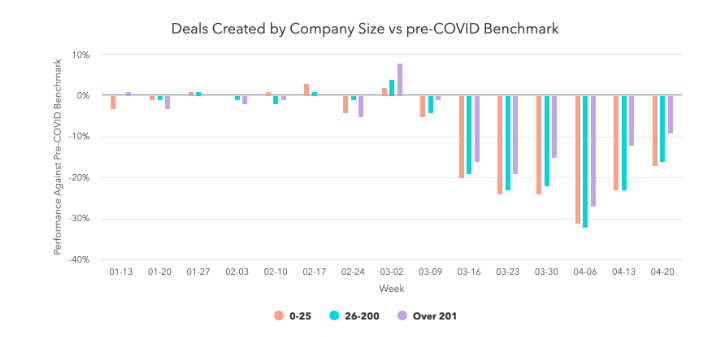

Companies with 201+ employees are the fastest to recover from the beginning of the COVID-19 hit.

Before you get too excited

A major point to note is that there’s a major gap in how salespeople are prospecting. Even though the email marketing send out rate has risen by 67% as compared to the pre-pandemic phase response rates suffer with unproportionate figures.

Plus, Episerver’s ‘second-annual B2B digital experience report’ indicated that there would be tension in terms of the impact of AI and automation on future job security.

Global inflation trends

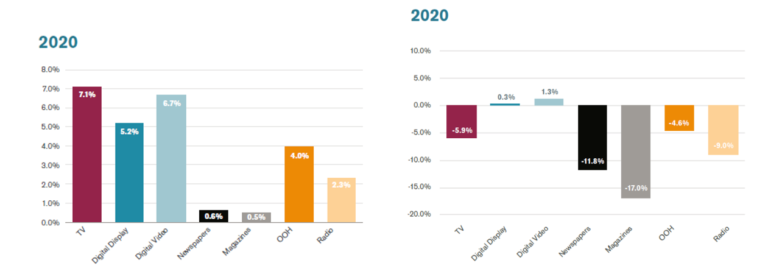

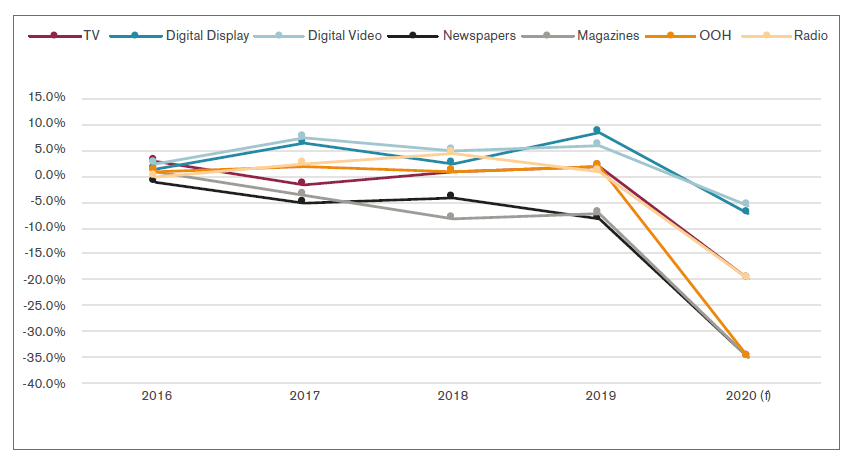

ECI Media Management recently released a flash update to its ‘2020 Annual media inflation report’ to record how media inflation has been affected by the coronavirus pandemic across 15 key markets.

Restrictions and reduced consumer activity have forced many brands to reduce their ad spend and almost all have revised their 2020 marketing activity. As a result, the increased amount of inventory available teamed with decreased advertising spend means media prices are dropping significantly, across all offline media. Despite increased readership, digital media are also being negatively impacted due to programmatic blacklists blocking keywords associated with coronavirus.

As the decade started, ECI forecast that global media inflation in 2020 would grow across the board, with TV inflation reaching 7.1% and Digital Video inflation increasing to 6.7%. All traditional media types are now predicted to deflate, with TV dropping to -5.9%, while Digital Display and Digital Video are the only media to see rising prices, with global inflation at 0.3% and 1.3% respectively.

High demand is leading to overall inflation for Digital, particularly in APAC, which is driving overall global digital inflation. However, Digital is deflationary in EMEA, with a number of key markets such as the UK, France and Spain seeing deflation due to huge increases in inventory combined with decreased demand. However, there is now an additional trend reducing the price drop on digital: the use of programmatic blacklists to block terms associated with coronavirus.

In the UK the TV market, in particular, is seeing extreme levels of deflation, with many clients deferring activity later in 2020, along with other offline media due to the decrease in demand. Unlike other global territories, digital in the UK is also expected to see deflation, thanks to high supply and demand.

Streaming behaviour and advertising

It’s no mystery that streaming services have flourished during the pandemic. Conviva, an integrated streaming intelligence platform revealed region-wise streaming data across TV, PC, live streaming, and video on demand.

Overall streaming region-wise

- Africa – 25%

- Americas – 57%

- Asia – 30%

- Europe – 70%

Mobile streaming region-wise

- Africa – 23%

- Americas – 67%

- Asia – 27%

- Europe – 58%

TV streaming region-wise

- Africa – minus 13%

- Americas – 48%

- Asia – 159%

- Europe – 99%

PC streaming region-wise

- Africa – 35%

- Americas – 18%

- Asia – 28%

- Europe – 19%

The Conviva survey 12.5 billion ad attempts in Q1 of 2020 vs Q4 2019, here are some key insights:

- 19.24% of the audience abandoned ads that had a five-second delay

- The exit rate for before the ad started was 5.75%

- Ad buffering was 3.51% better

- Ad start time was 2.64% shorter

Standard ads performed better than COVID-19 news ads

According to a study by Mediascience, COVID-19 related messaging worked well only in news environments.

From the brands’ ads studied Amazon was the only brand of which COVID-19 ads performed better in comedy environments as well as news environments. Pets’ ads related to COVID-19 performed better in comedy environments.

COVID-19 ads that didn’t do well in comedy environments:

- Fast food burger brand

- Finance

- Cleaning

- Ford

Finance and cleaning are two verticals that have been received well neither in comedy nor in news environments.

Where businesses can find their audience

WHO would be happy to know, the answer is, Indoors. But identity resolution solution Tapad recently managed to give us insights into exact screen times as per time of the day and device.

10 pm to 6 am was the sweet spot for finding people on their mobiles and tablets. CTV and desktop showed the most growth in the morning and afternoon during wfh and learn from home hours.

CTV and desktop showed the most growth in the morning and afternoon during wfh and learn from home hours.

People are increasingly spending time watching TV, set top boxes, gaming consoles from 10 pm to 6 am.

Spain and the UK were the only EU countries that saw increased activity across mobiles, tablets, and desktops.

Gartner reveals CMOs’ immediate budget actions

The COVID-19 related disruption has made 65% of CMOs and marketing leaders prepare for moderate to significant budget cuts.

“Marketing organizations are ill-prepared for COVID-19’s impact on the global economy and consumer sentiment, and this crisis will only exacerbate the budget strain we saw developing in 2019,” says Ewan McIntyre, Vice President Analyst, Gartner for Marketers.

CMOs in North America and the UK plan to slash advertising budgets for:

- TV advertising (32%)

- Offline advertising (32%)

- Event marketing (28%)

Gartner further suggested that CMOs create a ‘Tiger team’ that would be empowered to strong short-term strategic decisions that would benefit for long-term success.

The tiger team would be responsible to review costs affected due to :

- COVID-19 communications

- Changing consumer behavior

- Challenges of reduced revenue

What are people reading on ClickZ?

People are keen on buckling up for the post-COVID-19 business world, how marketers should strategize during the pandemic, and knowing how they can win consumer trust. These key insights articles prove to be very popular, thanks to you, our wise readers.

How to leverage AR, the benefits of an ABM approach, and a post-third party data world, are some other reader magnets we have this week.

Hungry for more insights?

Stay tuned for our article next week on the Peer Network briefing from Tamara Charm, founder and leader of McKinsey’s agile consumer insights division, on how marketers can manage the Coronavirus pandemic and plan for the future.

During her talk she provided findings from McKinsey’s exclusive research, and covered the following topics:

- Consumer sentiment and behavior

- What marketing leaders can do now

- How to plan for the recovery

- Reimagination and getting ahead of the ‘next normal’

The post Key insights: Consumer trust segmented, the power of push notifications, martech stacks lack strategy, and more appeared first on ClickZ.

from ClickZ https://ift.tt/3dbpgNV

via IFTTT

No comments:

Post a Comment